July 12, 2022

By Bob O'Donnell

Ask most anyone interested in major tech trends for business, and you’re bound to hear chatter about private 5G networks. After all, while 5G for consumers hasn’t really amounted to much (yet), 5G in the business world is supposed to make a big difference. Indeed, the general consensus seems to be that the potential value of and uses for 5G in the enterprise are abundantly clearer—especially in the near term—than they are for consumers.

The results from a recent study that surveyed 400 US-based IT decision makers about their current and/or planned usage of private cellular networks confirm those thoughts…to a degree. However, they also make it clear that the challenges facing companies currently deploying or planning to deploy these types of networks are bigger than many realize. Ultimately, it seems the real-world opportunities and benefits of private 5G are much more nuanced than many have been led to believe.

First, a few basics. Respondents to the study, which was fielded in March and April of this year, included individuals from both medium-sized companies (100-999 employees) and large enterprises (1,000+ employees) and included companies that had existing private cellular networks (11.5% of the total) as well as those planning to install one (the remaining 88.5%). The average expected time for deployment among the latter group was about 18 months from the time they took the survey, and interestingly, most planned to start with just a single-building indoor network. (For comparison’s sake, the largest group of existing private cellular networks, 39%, were also single building indoor networks, while another 28% said their networks covered an external campus as well as inside a single building.)

Given these geographic footprints, it’s probably not terribly surprising to learn that both existing private network users and the larger group planning to deploy later said that their top application was as a general-purpose network. On the one hand, it makes sense that companies would want to expand the range of connectivity options they can offer to their employees, but this type of application doesn’t necessarily take advantage of some of the unique capabilities, such as faster speeds and lower latency, that private cellular networks can offer. In fact, it’s these types of applications that give rise to questions about potential “battles” between cellular technology and WiFi for corporate networks. Of course, these types of questions have been around for years, but many within the networking world have downplayed them as being either unimportant or inconsequential because of the presumed peaceful co-existence of the two wireless technologies.

In the real world, the majority of survey respondents (72.5%) do believe or expect private cellular and WiFi to be complementary, but over ¼ said they see at least some replacement of WiFi by 5G, which is a very different (and more complicated) story than many in the industry have suggested.

On a related note, the results of what types of devices companies expect to have connected to their networks also puts an interesting twist on how companies are viewing private cellular. In fact, one of the biggest surprises from the study, shown in Figure 1, is that cellular-connected laptop PCs are the most popular choice for devices that companies believe will connect to their networks (and they were a very close number two to Other Specialized Devices on existing cellular networks).

Fig. 1

This is fascinating on multiple levels, not the least of which is that nearly every single survey respondent (96%) expects this to be the case. First, it speaks to the crying need for more cellular-connected PCs, which to date are still extremely rare in most businesses. In addition, it’s strong evidence that the availability of the kinds of gadgets that you might expect to find on a private cellular network—such as 5G-enabled specialized devices and connected IoT sensors among others—are still in short supply. As has been reported elsewhere, despite the big build-up and hype around 5G industrial applications, there doesn’t seem to be a sufficient number of industrial device makers building the kinds of machines and sensors that companies need to leverage the benefits of technologies like Ultra-Reliable Low Latency Communications (URLLC) that are such an important part of the 5G promise for business.

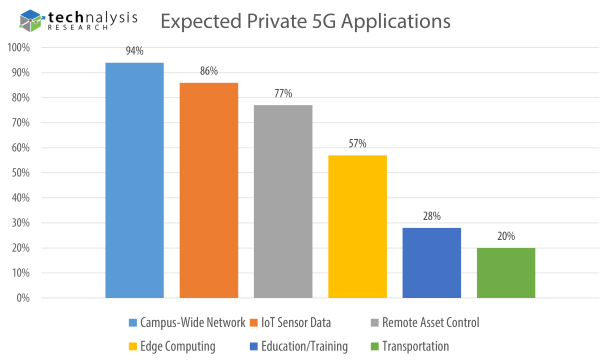

On the other hand, looking at their list of the top anticipated applications for private 5G (see Figure 2), shows that there is clearly still hope for things like IoT sensor data collection, remote asset control, and edge computing applications that many have predicted private 5G networks would enable. As one survey respondent put it, “Private 5G networks will be simple to scale and will manage large numbers of IoT-connected sensors and devices.”

Fig. 2

As hopeful as that respondent may be, there were many others, however, that were a bit more concerned. As another explained, “It will be a challenge for us as a team to successfully deploy a Private 5G network. It will require a highly skilled multi-vendor team to overcome the technical complexity challenges and to integrate our legacy systems with 5G.”

At a high level, the study results showed that companies are most excited about the potential for improved security, faster speeds, and increased efficiency enabled by private 5G networks, while they’re most concerned about limited internal skill sets with cellular network technology, technology complexities, and potential cost overruns.

Ultimately, the research suggests that excitement around private 5G networks is indeed very real, but it’s most certainly not a case of unbridled enthusiasm. Companies clearly aren’t looking at 5G technology purely for technology’s sake. Instead, they’re hoping to find clear evidence of the benefits it can provide their organizations. It’s not going to be as simple or as straightforward to achieve this as many first expected, but there is also no doubt that there’s an eagerness and willingness among many organizations to look for solutions to the real-world challenges they’re facing today.

If you’re interested in learning more, you can download a free copy of highlights from the TECHnalysis Research “Private 5G Networks: Defying Expectations” survey report here.

Here’s a link to the original column: https://seekingalpha.com/article/4522899-new-research-opportunities-challenges-private-5g

Bob O’Donnell is the president and chief analyst of TECHnalysis Research, LLC a market research firm that provides strategic consulting and market research services to the technology industry and professional financial community. You can follow him on Twitter @bobodtech. |